Here you'll learn more about our VIP campaign

|

Campaign goals and your contributions

|

How your VIP contribution will be used

Initial 12 months (3 quarters infrastructure + 1 quarter service testing)

|

|

| Total seed | $ 6,000,000 |

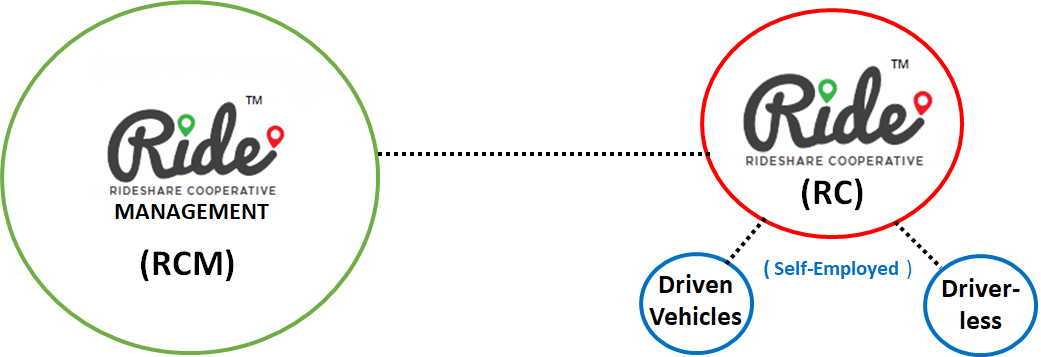

Ride's Cooperative Corporate Structure

|

Rideshare Cooperative cemented in its core values:

- Drivers retain 90% of their fares

- Drivers remain truly independent

- Relieve drivers from admin chores

- Profit sufficiently to rival competitors

- Maintain a lean corporate organization

- Refrain from non-ancillary investments

- Minimize fixed expenses to the extreme

Strengths ensuring Ride's competitive endurance

Competitive design

- Low overhead and minimal fixed costs means that Ride's expenses never exceed its revenue.

- Independence and greater earnings reduce driver anxieties and promote enthusiastic performance.

- Exceptional service at consistent competitive rates enables passengers to budget rides more accurately.

Ride is also positioned for competitive resistance

Competitive values

- Limiting service to passenger transportation, Ride remains unburdened by other investments.

- Ride's corporate values negate corporate bloat, maintaining a lean operational model and budget.

- While supporting driverless rides, Ride remains unhindered by losses in autonomous vehicle research.

- Unlike its competitors, Ride won't buy out competitors just to shut them down, thus avoiding wasteful debt.

Competitive Comparison

Here's how we compare at this time:

| Competitors |  |

|---|---|

|

|

Our competitors require hundreds of millions in revenue to service their debt while maintaining a heavy burden of fixed costs. Ultimately, we are in a stronger position because we have no debt and have almost no fixed costs.

Consequently, we are in a strong position to profit with very limited earnings while still remitting 90% of fares to drivers. In contrast, such earnings are insufficient for our competitors to adequately service their fixed costs, investments and debtload.

Rates and Revenue

| Rate Period | *Rate/Min | %/Wk (hrs/wk) | Fares/Wk |

|---|---|---|---|

| Base rate | $ 1.10 | 20% (8 hrs) | $ 528.00 |

| Heavy traffic | 0.90 | 60% (24 hrs) | 1296.00 |

| Airport | 1.25 | 10% (4 hrs) | 300.00 |

| Night/Holiday | 1.50 | 10% (4 hrs) | 360.00 |

| Average of driver gross earnings per week: | $ 2,484.00 | ||

| Average of driver gross earnings per year: | $ 129,168.00 | ||

*Rates may vary.

In our experience, our rates roughly represent Uber's and Lyft's lowest quoted rates.

Also in our experience, their rates vary greatly from ride to ride, and barring unusual circumstances our rates will remain consistent throughout rides and across passengers.

Our annual earnings are educated estimates based upon annual recorded global rideshare spending and the number of drivers that service rideshare clients.

Initially we'll be launching in a single region or two, just to identify and fix programming errors in preparation for our national launch. Thereafter, we'll be extending service into new regions one or two at a time, until we are satisfied that Ride's extensibility is smooth and uneventful. Then we'll immediately offer service nationally, and focus our efforts on servicing the global market.

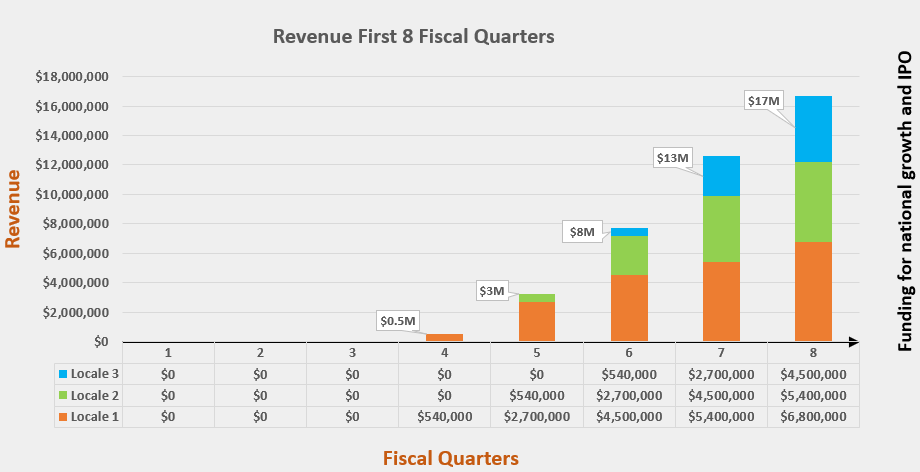

Speaking of timelines, here's a chart displaying the time commencing product development and through the end of our second year, at which time we may be ready to extend service nationally.